Commercial Real Estate

We help our clients reach their investment goals by advising and supporting them through all the investment process (property analysis, purchase, and exit strategy). Together with our partner and broker AG Real Estate Advisors we are capable of accessing all necessary tools and resources to accomplish any goal.

Resources:

Resources:

- Knowledge of the markets in which we identify investments

- Relationships with brokers, bankers and developers with access to opportunities

- Professional affiliations and associations at national level

- Demographic and geographic analysis systems

- Financial analysis teams

- Due diligence control and execution tools

- A team with more than 30 years of collective experience

- Strategic alliances with professionals in different fields, such as: attorneys, title companies, engineers, inspectors, appraisers and bankers, who will help bring each transaction to the closing table

Fundamentals

- The current U.S commercial real estate market offers attractive opportunities

- Lack of investment opportunities that preserve capital

- Hedge against inflation

- Diversification of capital and risk

- Investment that generate immediate cash flow

- Capital market constraint provides opportunities for investors with cash and low leverage requirements

- Attractive rates of capitalization (Cap rates)

- Potential leverage increase return on investment

- Mortgage loans at historical low rates

Implementation

- Identification of target markets

- Rigorous pursuit of opportunities in target markets

- Analysis of each opportunity, using the best tools and information systems

- Negotiation of terms with the sole purpose of benefitting investor’s interest

- Establishment of an appropriate legal structure and fiscal framework to take ownership of the property

- Assistance in obtaining financing for the acquisition of the property

- Implementation of a specific action plan to take each negotiation to the closing table without setbacks

- Definition of post closing procedures: rent collections and tenant communication

- Strong brand and business fundamentals. SWOT Analysis

- Strong sales from past years

- Analyze tenant

- Number of stores

- Debt to equity ratios

- Operating margins

- Stability of management

- Outlook of their industry sector

- Determine the probability of the tenant to remain leasing the property based on their current financials and projections.

- Analyze tenant

- Maximum amount of tenants from each industry. Diversify by city and industry

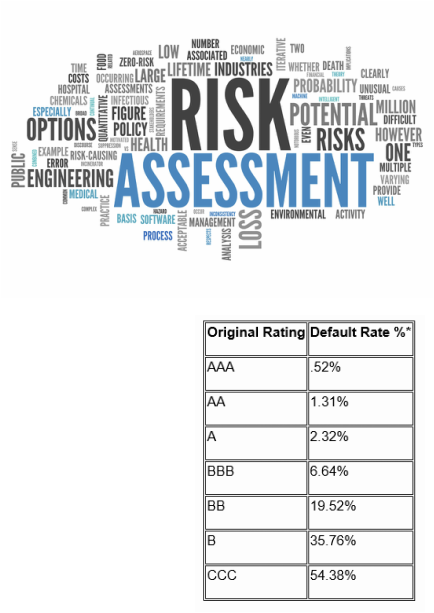

- Corporate guarantee leases. Minimum credit rating considered investment grade

- Rent increases of minimum 10% every 5 years.

- Minimum cap rate 5%

- Nature of the improvements. Are the improvements easily converted for another tenant or are they special purpose that would require significant expense and time to convert before re tenanting

- Age and condition of the improvements

- Minimum location guidelines

- daily traffic of more than 30,000 cars per day

- Strong demographics of median house hold income of minimum $30,000, and a 5 mile radius population of minimum 50,000

- Possible climate risks and plans to mitigate. Insurance coverage against property and what would be the amount recovered to cover the equity plus all additional costs incurred to purchase the property.

- Repairs and maintenance need in the short and long term

- Diversify by market and type of businesses

- Backup plan to establish solutions for worst case scenario in which the existing tenant vacates the property.

- Time frame to establish a new lease

- Additional costs to lease (Commissions)

- Cap rate based on market rents

- Type of tenant

- Possible future value

Due diligence

- Market conditions

- Analyze local market condition

- Demographic trends of population growth, income, and employment in the local market

- Local rental rates

- Occupancy levels

- Competitive space supply

- Final price per sqft and residual value at exit strategy

- Overall marketability of the property

- Property condition

- Inspection report that determine the physical condition of the building, environment matters and structural components

- Title, zoning, and land use regulations

- Environmental report: Phase 1

- Investment plan

- Financial analysis based on maximum leverage amount

- Possible solutions for a worst case scenario

- Appraisal

- Comparable recent sales

- Replacement costs

- Capitalization of income method